nj employer payroll tax calculator

Employers must be registered with the State of New Jersey for payroll tax purposes to file Forms NJ-927 NJ-W. Unemployment insurance FUTA 6 of an employees first 7000 in wages 2022 2.

Tax Payroll Calculator Online Save 35 Kawaleesnews Com

Calculate your New Jersey net pay or take home pay by entering your per-period or annual salary along with the pertinent federal.

. Employer Payroll Tax Electronic Filing and Reporting Options. Use ADPs New Jersey Paycheck Calculator to estimate net or take home pay for either hourly or salaried employees. New Hire Operations Center.

Could be decreased due to state unemployment. It is not a substitute for the advice. The standard FUTA tax rate is 6 so your.

Withhold 62 of each employees taxable wages until they earn gross pay of 147000 in a given calendar year. The information provided by the Paycheck Calculator provides general information regarding the calculation of taxes on wages for New Jersey residents only. Enter the payroll information into Incfiles easy Employer Payroll Tax Calculator.

Unemployment and Temporary Disability contribution rates in New Jersey are assigned on a fiscal year basis July 1 st to June 30. New Jersey new hire online reporting. Your employer uses the information that you provided on your W-4 form to.

Use Gustos salary paycheck calculator to determine withholdings and calculate take-home pay for your salaried employees in New. How to File Your Payroll Taxes. Medicare 145 of an employees annual salary 1.

Subtract 12900 for Married otherwise. Calculating paychecks and need some help. Just enter the wages tax withholdings and other information required.

FUTAs maximum taxable earnings whats called a wage base is 7000 anything an employee earns beyond that amount isnt taxed. Employer Payroll Tax Electronic Filing and Reporting Options. Federal income taxes are also withheld from each of your paychecks.

The maximum an employee will pay in 2022 is 911400. Expenses that may be deducted in New Jersey include certain unreimbursed medical expenses New Jersey property taxes Archer MSA contributions and if youre self. 2020 Federal income tax withholding calculation.

Abacus Payroll and Alloy Silverstein present a summary of all the payroll tax changes that New Jersey employers or business owners need to know for the 2022 calendar. Multiply taxable gross wages by the number of pay periods per year to compute your annual wage. New Jersey New Hire Reporting.

New Jersey Salary Paycheck Calculator. How Your New Jersey Paycheck Works. Employers must be registered with the State of New Jersey for payroll tax purposes to file Forms NJ-927 NJ-W.

Rate information contributions and due dates. Prepare your FICA taxes Medicare and Social Security monthly or.

How To Calculate Payroll Taxes Futa Sui And More Surepayroll

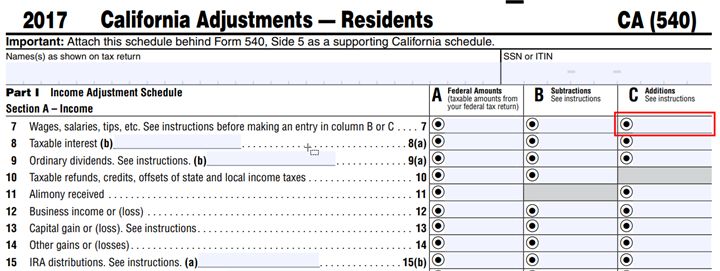

California And New Jersey Hsa Tax Return Special Considerations

Payroll Tax Rate Updates For 2022 Sax Llp Advisory Audit And Accounting

Payroll Tax Calculator For Employers Gusto

What Does A Wr 30 Look Like How Do I Do It Paladini Law

Division Of Unemployment Insurance Faq Paying Federal Income Tax On Your Unemployment Insurance Benefits

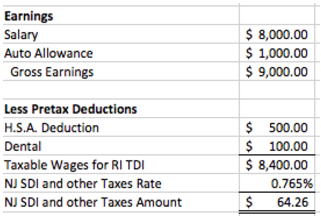

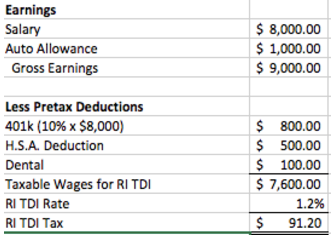

How Are State Disability Insurance Sdi Payroll Taxes Calculated

State Withholding Form H R Block

Salary Paycheck Calculator Calculate Net Income Adp

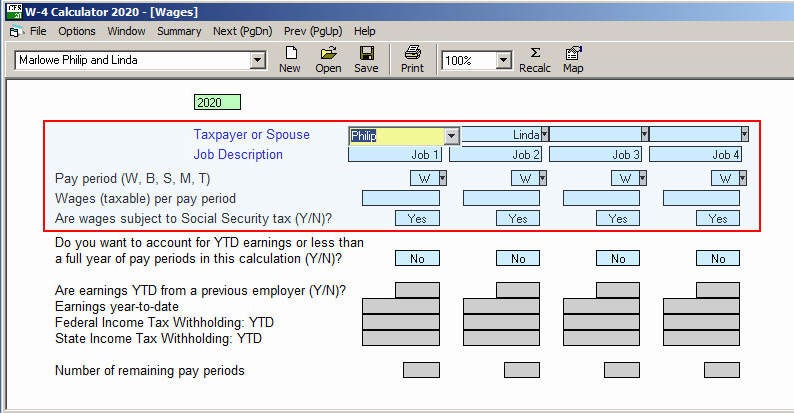

W 4 Calculator Cfs Tax Software Inc

How Are State Disability Insurance Sdi Payroll Taxes Calculated

2022 Federal State Payroll Tax Rates For Employers

Live And Work In Indiana But Paid Out Of Nj

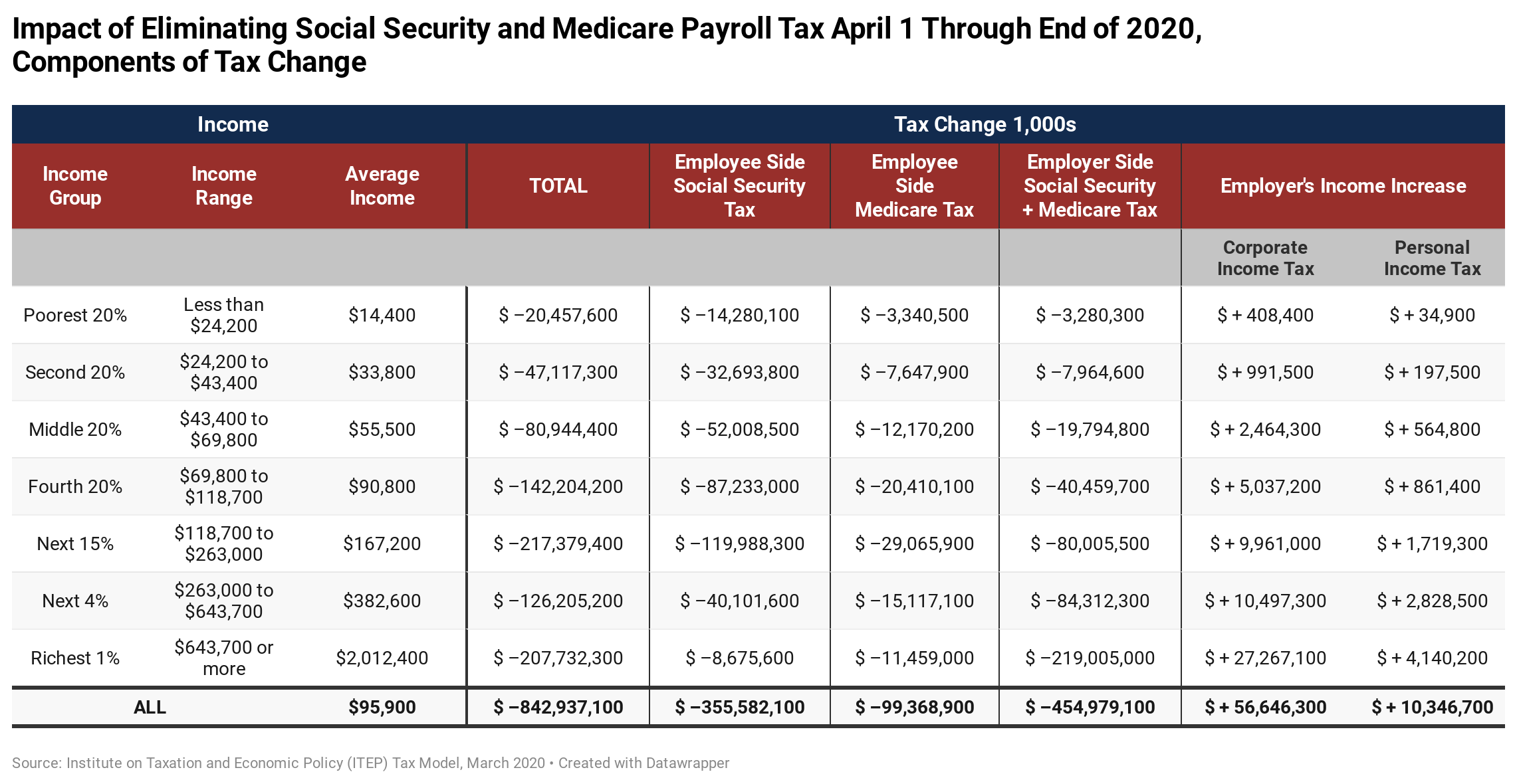

Trump S Proposed Payroll Tax Elimination Itep

Federal Income Tax Fit Payroll Tax Calculation Youtube

Division Of Employer Accounts Rate Information Contributions And Due Dates

Free Employer Payroll Calculator And 2022 Tax Rates Onpay